Hey, hey, hey! Are you here because you want the deets on the new 1099 form? Or, are you here because you’re wondering what the heck a 1099 form is? Don’t worry I’ve got you covered!

So what the heck is a 1099?

Well, basically the 1099 Form is the government’s way of making sure that us entrepreneurs report our income. In its most simplistic explanation: the 1099 is a form that reports how much you paid a particular vendor during the year.

You will send the form to vendors (independent contractors) that you paid more than $600 to. The form will provide them with a record of their income from you and you will also send the report to the IRS so that they also have a record of how much you paid the vendor.

This is essentially the government’s way of making sure that income is being reported. Now in some cases you will also have to send this report to the state, if the state requires it, and I have more details on that below.

You should also know that you may be receiving 1099s from your clients if you yourself meet the requirements, which I will be breaking down further so stick with me.

What are the 1099 changes for 2020?

Prior to 2020, if you were an independent contractor or your small business hired independent contractors for work, you either issued or received a 1099-MISC. This form was used to report miscellaneous income such as what was paid to independent contractors and/or what you paid your landlord in rent.

Now, the IRS has introduced the Form 1099-NEC which is just for reporting independent contractor income (officially known as “non-employee compensation”). If you utilize independent contractors within your business or you yourself work as one, here’s everything you need to know about this form.

What is Form 1099-NEC?

The 1099-NEC (see it here) is a new form that is exclusively for reporting non-employee compensation. What is “non-employee compensation? It is currently defined as payments to individuals not on payroll on a contract basis to complete a project or assignment.

This would include all independent contractors, gig workers, or self-employed individuals who previously had their payments reported on the 1099-MISC form.

So now that we are using the 1099-NEC what do we do with the 1099-MISC?

Well the 1099-NEC will be used to report independent contractor income. But the 1099-MISC form is still around, and will still be used.The 1099-MISC will be used to report miscellaneous income such as rent, royalties or payments made to an attorney (not for legal services but as a settlement in a case).

Who requires a Form 1099-NEC?

If your business paid a contractor more than $600 for the year via a check, cash or ACH/debit card then you’re required to file Form 1099-NEC. If you paid the contractor via Paypal or with a credit card then you do not have to send them a 1099-NEC.

Why? Well it’s because the credit card company/Paypal reports their income so you don’t have to worry about a thing!

Now I do want to point out an exception. If the independent contractor that you paid more than $600 to via a check, cash or ACH/debit card is registered as a C corporation or S corporation, a 1099-NEC will not be required.

I also want to reiterate that this form is for independent contractors only which means that you do not file a 1099-NEC for your employees. Instead, your employees will receive a W-2 to report their wages, tips, and other compensation paid during the tax year.

Who requires a Form 1099-MISC?

If your business paid an individual or LLC at least $600 during the year in rent (landlord), legal settlements, or prize or award winnings, or $10 in royalties you are required to file a 1099-MISC. Again, it doesn’t get more miscellaneous than this. Think of this form as the catch-all!

How do you file Form 1099-NEC?

For every Form 1099-NEC, there are two copies that you will need to fill out with the same exact information: they are called Copy A and Copy B. You will send Copy A to the IRS and Copy B to the contractor.

What you need to file?

You will need a W9 from the contractor. The W9 will include their:

*Legal name or business name if applicable.

*Business entity (sole proprietor, partnership, corporation).

*Current address.

*Taxpayer identification number (SSN, ITIN, or EIN).

In addition to the W9 you will need to know how much you paid the contractor throughout the year. I suggest using a software such as Quickbooks Online to track this, you can access my affiliate discount for 50% off your first six months here.

And if you don’t want to deal with tracking or filing any of this on your own, you can check out Gusto. Gusto will manage all of this for you and you can use my affiliate link here to receive $100 gift card after you sign up!

As long as you have the information from the W9 and the total that you paid the contractor for the year you are ready to fill out the 1099.

How to submit Copy A to the IRS:

There are two ways that you can submit Copy A to the IRS. You can submit the form electronically or via the mail. Please note that if you wish to mail it you can not download this form from the internet and print it.

Why? Because the forms are scanned in and therefore must be printed on special paper. This means that you will need to request for copies to be mailed to you. You can make this request at irs.gov.

If you want to file electronically, you will do so through the IRS’s FIRE (Filing Information Returns Electronically) System. Before using FIRE, you will need a Transmitter Control Code (TCC). This must be requested by mailing or faxing Form 4419 to the IRS.

This must be submitted at least 30 days before the tax deadline for your Form 1099-NEC. The IRS will contact you with your TCC which can be used to create an account with FIRE.

How to submit Copy B to the contractor:

There are two ways that you can submit Copy B to the contractor. The first is to mail it. The second is to email it but there is a bit of red tape to deal with if you go this route. You can only email Copy B to your contractor if you have received their consent to email it.

Consent will need to be obtained through the same way you plan on sending the document. This means that you need to email them asking for consent to email them Copy B. If they don’t email you back with consent then you will have to mail it.

And because nothing can be simple there are of course requirements of the what the email consent must contain:

*Affirmation of the fact that, if the recipient does not consent to receiving an electronic copy, they will receive a paper one.

*The scope and duration of their consent. For instance, are they agreeing to receive an electronic copy this year, or every calendar year they work for you?

*How to request a paper copy from you, even if they have given consent to receive an electronic one.

*Instructions on how to withdraw consent. They may withdraw consent at any time in writing, electronically or on paper. You must also confirm their withdrawal in writing.

*Under what conditions the statement may no longer be provided—for example, if the contractor’s contract is cancelled, or if you end up paying them less than $600 for their services.

*The procedure they need to follow to update their information with you.

*A description of the hardware and software they need to view and print the form.

*A date at which the form will not be available. For example, if you are making it available to download via your company’s website, you must tell them at what point in time the form will be removed from your servers.

Once you’ve received consent from the contractor, you are free to send them their Copy B electronically.

Submitting 1099 forms with your state

So as I mentioned before, some states require you to submit a 1099. Here is a list of states that do not require 1099 forms to be submitted:

Alaska

Florida

Illinois

Nevada

New Hampshire

New York

South Dakota

Tennessee

Texas

Washington

Wyoming

There are also some states that have a program set up with the IRS where the IRS will forward the information you submit to the state so that you don’t have to do anything extra. You will want to research/ask your CPA to get the deets based on the state in question.

When is the 1099-NEC due?

The due date to file Copy A of Form 1099-NEC with the IRS is January 31 of the following year. If this date does not fall on a business day, the due date will be the next business day.

Since January 31st falls on a Sunday this year the due date is Monday, February 1, 2021.

Similarly, the deadline to provide Copy B of Form 1099-NEC to contractors is January 31 of the following year.

What are the penalties for missing the filing deadline?

If you missed the deadline, you will pay a penalty depending on how late the payment is. These penalties are:

*$50 if you file within 30 days

*$100 if you file more than 30 days late, but before August 1

*$260 if you file on or after August 1

The amount will be determined based on when you file the return. If you are unable to file on time, you can request an extension by submitting Form 8809 to the IRS. However, you will still need to supply the 1099-NEC forms to any contractors by January 31 but the extension will cover you with the IRS submission deadline.

So now what?

Ok, so I know this was a lot of information! Here is what I want you to do. Start with compiling a list of any contractors that you paid more than $600 in 2020. Then I want you to determine if they are an S corporation or a C corporation.

If they are then remove them from your list. If they are not I want you to collect a W9 from them. You can download one here. Once you have their W9 the only other piece of information you will need is how much you paid them. Now you are ready to file!

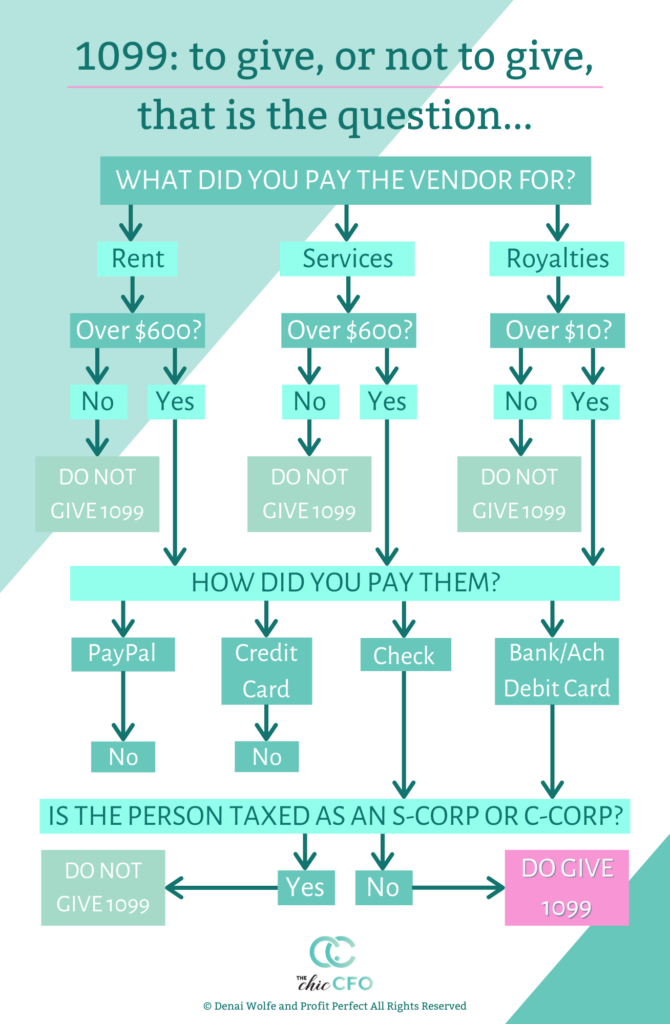

Still confused? Check out this chart!

Still need help?

Shoot me a note! I am happy to take this off of your plate! [email protected]

I know this was a TON of info! If you still have more questions please head over to my private Facebook Group where we are constantly posting updates and going Live to answer your questions!

https://www.facebook.com/groups/theprofitfactor/